As much as you may try to deny it, there will come a time where you have an accident with your phone. Whether you drop and shatter its display, accidentally knock it into the sink, or anything else in between, no one is perfect when it comes to phone ownership. Rather than live on the edge and risk paying hundreds in repair fees, you could do yourself a favor and sign up for a phone insurance provider. From our top pick of SquareTrade to any of the other brands mentioned on this list, here are the best ways you can protect your phone in 2021.

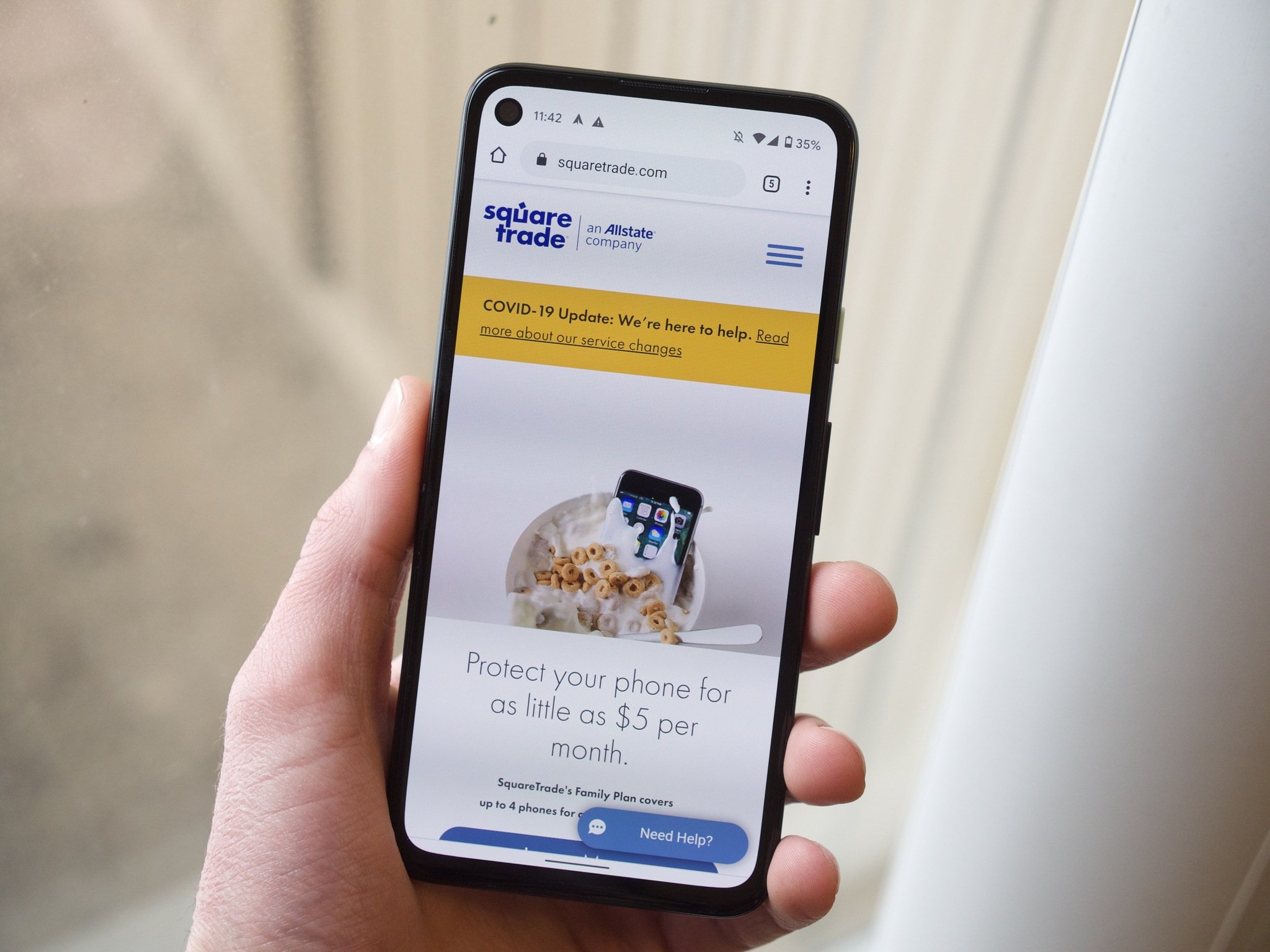

Best Overall: SquareTrade

Kicking things off, we have to talk about SquareTrade. SquareTrade is the most iconic name in the phone insurance world, and as you might expect, there's a very good reason for that — it's a damn good insurance provider.

SquareTrade has two plans to choose from, including Single Plan and Family Plan. The former costs $8.99/month for one phone and the latter will run you $19.99/month for up to four phones. Those are pretty competitive monthly rates, especially if you can take full advantage of the family option. Even better is that you can use SquareTrade for virtually any phone. No matter if it's new or used, unlocked or tied to a carrier, SquareTrade will protect it.

As for what kind of protection you'll be getting, SquareTrade covers all of the following:

- Cracked screen

- Liquid damage

- Battery failure

- Touchscreen failure

- Speaker/audio failure

- Charging port failure

You get access to a variety of same-day repair options with SquareTrade, including in-home repairs, service at local repair shops, and at the Genius Bar at Apple Stores. If you'd rather not go anywhere, SquareTrade also offers mail-in repairs that are completed within 2-5 days. Single Plan members can file up to four claims per year while the Family Plan is allotted up to eight.

Perhaps the biggest downside to SquareTrade is the cost of its deductibles. No matter what kind of repair your phone needs, SquareTrade charges $149 for every single claim. This does keep things easier to understand compared to other insurance providers that have different prices for certain phones and repair types, but on the other hand, you'll find much cheaper deductibles with other options on this list.

Even with that said, we still think SquareTrade is the best choice for most people. It's incredibly easy to sign up for, works with virtually any smartphone you have, and comes with years of experience and trust having first launched back in 1999. You really can't go wrong with this one.

Pros:

- Can be used for any new/used phone

- Works with all phone carriers

- Covers cracked screens, liquid damage, and more

- Single and family plans

- Same-day repair options

Cons:

- High deductible

- No theft protection

Best Overall

SquareTrade

Best in the business

With broad coverage and years of experience, SquareTrade needs to be on your insurance shortlist.

Best Alternative: AKKO

Where SquareTrade is an easily-recognizable company most folks are probably familiar with, AKKO is a young start-up based out of California that's trying to best SquareTrade at its own game. And you know what? It's doing a pretty fantastic job so far.

AKKO's Phone Only plan ranges between $6 and $12/month depending on your phone, making the monthly cost potentially more expensive than SquareTrade. Even at the max $12/month rate, however, AKKO makes up for this with incredible coverage terms. Here are the specifics:

- Phone damage ($29 - $99 deductible)

- Phone theft/replacement ($75 - $99 deductible)

The term "phone damage" is pretty broad, but looking through AKKO's website, it confirms that you'll be protected against cracked screens, spills/liquid submersion, accidental damage (a.k.a drops), and a variety of other potential issues. It's also great to see that theft protection is here because as you might have noticed above, that's not something you get with SquareTrade. Furthermore, AKKO doesn't have any limit on how many claims you can make per year. Each claim/incident has a $2,000 coverage maximum, but whether you need to make one, two, or 10 claims in a single year, AKKO will have your back.

While this roundup is focusing specifically on phone insurance plans, we also want to mention the AKKO Plan that's offered alongside the Phone Only one. It costs between $12 and $15/month and comes with all of the same benefits outlined above, but you also get coverage for all of your other electronic devices — up to 25 devices. Whether it's a TV, camera, sports equipment, or anything else in between, it's covered by the AKKO Plan.

The only potential issue to all of this is that AKKO has only been around since 2018. That's not to say AKKO isn't legitimate in any way, but some customers may just feel more comfortable going with a provider that's been around for a bit longer.

Pros:

- Coverage for any phone

- Deductibles start at $29

- Includes theft protection

- Optional protection for other gadgets

- Offers same-day repairs

Cons:

- Potentially more expensive monthly rate

- Only been in business since 2018

Best Alternative

AKKO

Incredible coverage, amazing prices

AKKO's prices and coverage sound too good to be true, making this insurance provider all the more compelling.

Best for Samsung Phones: Samsung Care+

Samsung is responsible for creating some of the best Android phones we see every single year, but just like any other phone, they're every bit as susceptible to accidents. You can cover Galaxy handsets with third-party programs like SquareTrade and AKKO, and while those are two excellent options, you should also strongly consider Samsung Care+.

This is an insurance program offered exclusively for Samsung Galaxy devices, and taking a look at the program, there's a lot to like. Samsung offers screen repairs for just $29, you get an extended warranty after your initial 12-month manufacturer's warranty ends, and you're protected against things like drops and liquid spills. As for how many claims you can make, Samsung Care+ allows for three per year.

In addition to all of that accident coverage, Samsung Care+ also gives you access to a 24/7 customer support line if you need help with virtually anything on your phone. From data transfers, troubleshooting, or just general tips/tricks, you can get help from a Samsung expert at a moment's notice.

There's also something to be said about buying insurance from the same company that made your phone. SquareTrade and AKKO offer excellent coverage despite being third-party operators, but if you own a Galaxy device, having insurance that's so tightly-integrated could be appealing.

Pros:

- Drops, liquid damage, and cracked screens are covered

- Serviced with original Samsung parts

- Includes an extended warranty

- $29 cracked screen deductible

- Free replacement phone during repair process

Cons:

- Exclusive for Samsung phones

- No theft protection

Best for Samsung Phones

Samsung Care+

Direct from Samsung itself

Ready to protect your new Galaxy phone? Samsung's first-party solution with Samsung Care+ has a lot to offer.

Best for Pixel Phones: Google Preferred Care

Speaking of first-party insurance options, let's now shift to Google Preferred Care. Similar to Samsung Care+, Google Preferred Care is insurance you can get only for Pixel phones. Here's why it could be a good option for you.

Google Preferred Care ditches monthly fees for one-time payments. Pricing works out as follows:

- Pixel 4a — $99 per device

- Pixel 4a 5G — $99 per device

- Pixel 5 — $149 per device

Google Preferred Care covers a variety of potential incidents, including cracked screens, liquid spills, and other types of accidental damage. Deductibles are handled at a flat rate regardless of what's being repaired — Pixel 5 owners pay $129 and Pixel 4a/4a 5G owners pay $99 — and you can make up to two claims per coverage term. As far as claim limits go, Google Preferred Care is definitely one of the weaker contenders.

So long as you aren't constantly breaking your phone, the experience is pretty seamless. You can ship your Pixel out for repairs and get a free replacement device during that time, or if you prefer a walk-in option, Google's partnered with uBreakiFix to offer $30 service discounts for Pixel 5, 4a 5G, and 4a owners. If you're still not impressed, Google Preferred Care also throws in an extra year of warranty coverage!

Preferred Care may not be for everyone, but if you have a Pixel and like the idea of paying a one-time fee rather than an ongoing month-to-month charge, it could be a great fit.

Pros:

- One-time fee per device

- Protects drops, liquid spills, and more

- Extended warranty

- Replacement devices available

- Same-day walk-in locations

Cons:

- Limit of 2 incidents per coverage term

- Only for Pixel phones

Best for Pixel Phones

Google Preferred Care

Pay once and you're done

Who has time for monthly fees? Pay a one-time rate with Google Preferred Care and get years of reliable coverage.

Best for iPhones: AppleCare+

Samsung Care+ and Google Preferred Care are solid options for Android users, but what about those who prefer iPhones? That's where AppleCare+ comes into play. AppleCare+ is the reason we see first-party insurance programs from Samsung and Google in the first place, and here in 2021, it's still standing strong as one of the most robust offerings out there.

The cost of Apple Care+ depends on what model iPhone you have, with the current rates going as follows:

- iPhone SE — $4/month or $80 outright

- iPhone 8 — $6/month or $130 outright

- iPhone 12, 12 mini, 11, XR, and 8 Plus — $8/month or $150 outright

- iPhone 12 Pro, 12 Pro Max, 11 Pro, 11 Pro Max, XS, XS Max, and X — $10/month or $200 outright

We love that Apple allows you to pay monthly or with a one-time fee, giving you the flexibility to work with whatever budget you may have. As for the coverage you get with AppleCare+, it's pretty strong.

Should you find yourself with a broken/cracked screen, you can get it replaced for just $29. Any other types of accidental damage will run you $99 per incident. As for how you go about getting your iPhone fixed, Apple gives you a few different options. You can take it to your local Apple Store (or an Apple Authorized Service Provider), have someone come to your home/office for screen repairs, or mail-in your iPhone and get a free replacement device while you wait.

AppleCare+ also includes a free battery replacement if your iPhone's battery is at less than 80% of its original capacity, and if you need help using your new phone, you have priority access to 24/7 technical support. Furthermore, you can pay a bit more for AppleCare+ with Theft and Loss to get protection for lost or stolen iPhones.

The biggest downside to AppleCare+ is that you're limited to two incidents per year. That should be fine for most people, but when compared to options like SquareTrade and AKKO, it is a downgrade worth mentioning.

Pros:

- Plans start at just $4/month

- $29 screen repairs

- Optional theft/loss coverage

- Same-day service at Apple Stores

- Priority access to 24/7 tech support

Cons:

- Maximum two incidents per year

Best for iPhones

AppleCare+

Phone insurance done the Apple way

If you own an iPhone and need insurance, it's hard to do better than AppleCare+. It's that simple.

Best for Verizon: Verizon Protect

Verizon is the largest wireless provider in the U.S., and while its prices aren't the cheapest, its coverage is among the most robust. That idea holds true with the carrier's phone insurance, which features a high monthly cost but gives you excellent protection and features across the board.

If you can stomach Verizon Protect's $17/month asking price (or $50/month for 3-10 devices), the coverage on offer is honestly impressive. Whether you have accidental damage, someone steals your phone, or you just happen to lose it, Verizon Protect has your back. You'll get unlimited $29 screen repairs, same-day replacement devices, and free battery replacements as needed. Outside of screen repairs, you get three claims per year for other damage.

That level of protection is great on its own, but that's only part of the story with Verizon Protect. The program comes with a few other perks, including:

- Expert advice for using and setting up your phone

- Wi-Fi security and protection

- Identity theft monitoring

- ID for unknown numbers

For Verizon customers that need quality phone insurance and can benefit from the added perks that are included, Verizon Protect has a lot to offer.

Pros:

- Covers damaged, stolen, and lost items

- Unlimited screen repairs

- Free battery replacements

- Same-day device replacement

- Comes with online protection, identity theft monitoring, and more

Cons:

- Most expensive monthly fee

- Exclusive for Verizon customers

Best for Verizon

Verizon Protect

More than phone insurance

Want a phone insurance plan that does more? Verizon Protect is an incredible (if expensive) option.

Best for AT&T: AT&T Protect Advantage

Last but not least, we have AT&T Protect Advantage. This is phone insurance available exclusively to AT&T customers, and similar to Verizon Protect, it has a bit more to offer than just traditional insurance.

AT&T Protect Advantage is available in two different tiers — including $15/month for one phone or $40/month for up to four. Both plans give you $29 screen repairs, same-day device replacement, unlimited battery replacement, theft/loss protection, and support for a variety of troubleshooting issues (device tune-ups, streaming support, and more). The $15/month plan for one device allows for three claims per year while the $40/month family plan allows for up to eight claims.

An especially nice perk of AT&T Protect Advantage is that you get unlimited photo and video cloud storage, giving you a way to store all of your digital memories without having to pay for a service like Google Photos or Dropbox.

If you don't think you'll make use of those extra perks, AT&T does have a more basic insurance offering for just $9/month per device. Under that plan, you'll get $49 screen repairs, two claims per year, and next-day device replacement.

Pros:

- Protection for lost, stolen, and damaged phones

- Unlimited battery replacements

- Includes unlimited photo/video cloud storage

- Premier customer support

- Prices start at $9/month

Cons:

- Up to three claims per year for a single device

- Only for AT&T customers

Best for AT&T

AT&T Protect Advantage

Insurance + cloud storage = 😃

Phone insurance, tech support, and cloud storage in one package. That's what you get with AT&T Protect Advantage.

Bottom line

Considering that everyone has different types of phones, different priorities, and different budgets, picking a single insurance provider as the best overall is a tricky thing to do. That said, we have to give props to SquareTrade for offering one of the most complete overall packages.

You can sign up for SquareTrade regardless of what smartphone you have, and at just $9/month, it's also pretty affordable. Everything from cracked screens to liquid damage to battery failure is covered with SquareTrade, and with a variety of repair options, you can get your phone fixed exactly how you prefer.

SquareTrade also gets points for the reputation it carries. Not only has SquareTrad been in business since 1999, but it's also owned by Allstate — one of the most recognizable insurance companies in the United States. Sure the $149 deductible may not be the most affordable, but all-in-all, SquareTrade is one of the easiest insurance providers to recommend to most people.

Credits — The team that worked on this guide

Joe Maring is Android Central's Senior Editor and has had a love for anything with a screen and CPU since he can remember. He's been talking/writing about Android in one form or another since 2012 and often does so while camping out at the nearest coffee shop. Have a tip for the site? Reach out on Twitter @JoeMaring1 or send an email to joe.maring@futurenet.com!

Tidak ada komentar:

Posting Komentar